AI Is Transforming CPG Distribution

What I learned from spending months going deep with brands, brokers, distributors and retailers.

Here we’re sharing with you with the conversations happening across team Maveron — including what’s now & what’s next, perspectives beyond the boardroom, and the long view on consumer shifts we believe will stick around for the years ahead.

Distribution in the consumer category hasn’t actually changed, but how brands get distribution is being rewritten in real time. AI is turning what used to be a relationship game into an intelligence game. And the brands that win shelf space, retail partnerships, and community mindshare aren’t just the ones with great products. They’re using data-based prediction and automation to win access. In a category where channels are fixed, the advantage now lies in how intelligently you play them.

At the same time, going omnichannel has become critical for upstart consumer brands. It drives growth, revenue diversification & stickiness, and ultimately, it’s what both private equity firms and strategics look for in an attractive target (with a few exceptions, like Rhode). The evidence is loud and clear: early brands are expanding into channels like grocery, club and mass-market in the U.S. and abroad, much faster than ever before because they realize this isn’t just important for taking off, but also for landing the plane. And importantly, they’re doing this with smaller teams and fewer resources.

In an effort to better understand this distribution dynamic, I spent a few months going deep with brands, brokers, distributors and retailers. These conversations led me to 4 key insights on the vertical AI omnichannel enablement opportunity for brands and early-stage investors:

The future is fast-moving, new brands. Standalone consumer brands that deliver better benefits and drive traffic across multiple channels through authentic messaging will replace traditional “Houses of Brands” that must acquire or launch competitors to upstarts to remain relevant. These new brands will likely operate with extremely lean teams, instead relying on agentic tools to do more, with less.

Ample room for automation. Consumer companies are primed to adopt AI native solutions that bring efficiencies to how they operate across customer experience, marketing, finance, operations, and product development. Automation here could meaningfully move the needle for overall revenue potential, driving faster growth and stronger unit economics.

AI can accelerate speed-to-shelf across channels. AI can help identify online trends in real time, allowing brands to more quickly respond by incorporating these insights into products, customer experience, and marketing assets. In a world where trends change rapidly, staying on top of this is a growing imperative for brands. Brands win by staying close to their customers.

Leverage AI to move across functions. The most compelling investment opportunities enabling omnichannel expansion will use AI to bridge the data gap across functions within a team, specifically finance, operations and marketing. Each of these 3 teams must work in concert to launch and scale across multiple distribution channels, but are often working in either non-AI-native tools or in siloed AI point solutions.

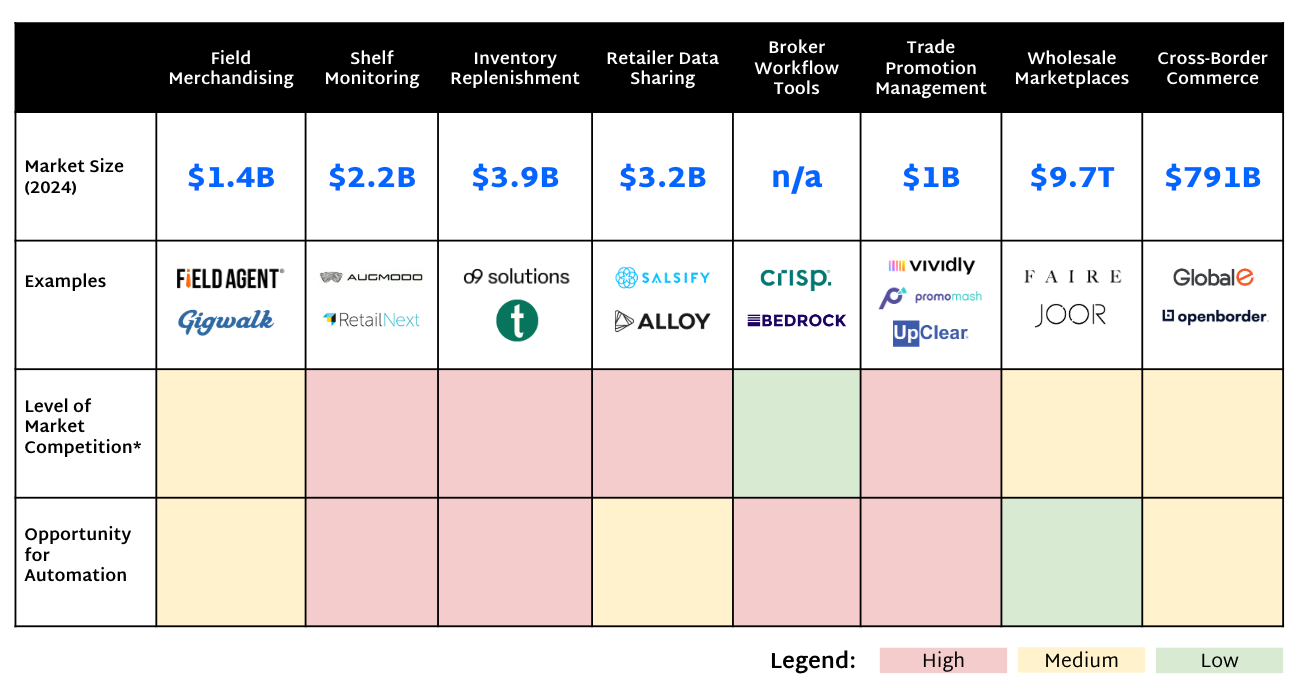

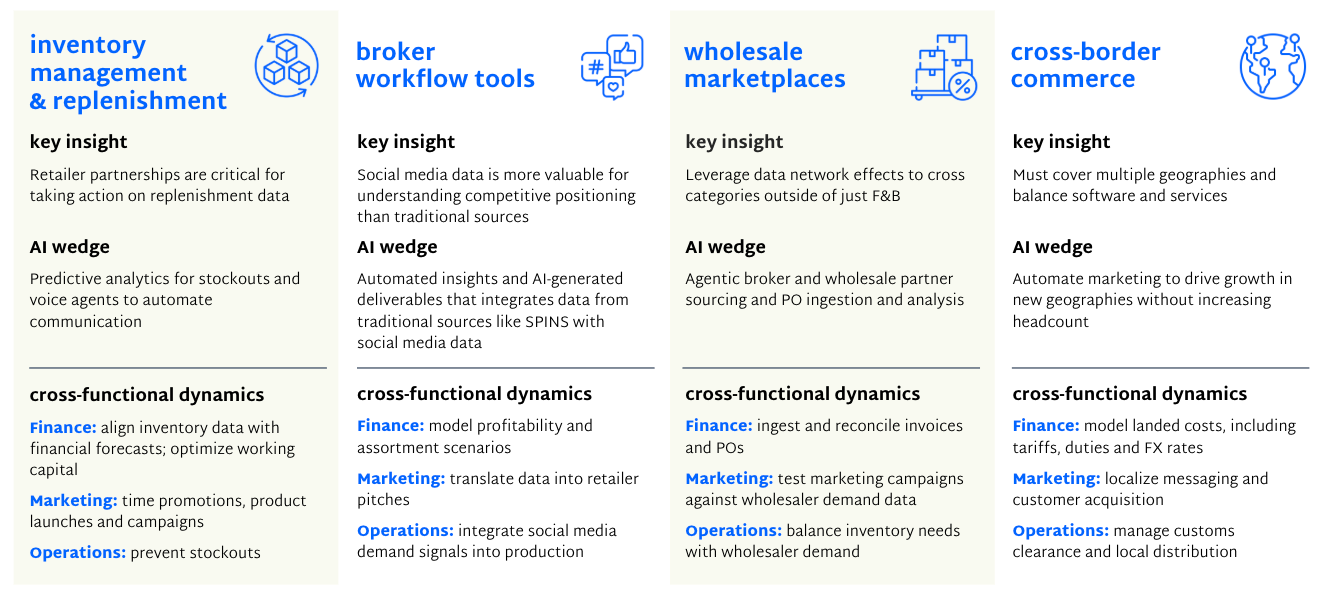

Our early thoughts are that the biggest areas for cross-functional AI impact and strong business fundamentals are inventory management and replenishment; broker workflow tools; wholesale marketplaces and cross-border commerce.

Each of these areas represents a key stage in the omnichannel expansion process. Brands begin by seeking out brokers to land retailer and wholesaler contracts, which they must ultimately fulfill and scale through accurate inventory management and replenishment. Once brands have meaningful scale and customer love, expanding internationally drives even more top-line growth. That said, we’re strongly of the belief that AI will continue to impact these value creation opportunities and more investment potential should emerge over time.

I’ll be continuing to track this space, both for potential investments and for our portfolio companies. If you’re building here, let me know! And if you want to learn more about Maveron’s POV on omnichannel distribution, check out my full investment thesis here.

On Snif’s Latest Creative Risk

“We always wanted to disrupt scent for guys (we’ve always been genderless), but we also realized they had different tastes and preferences. This set us off on a path of building a brand and a set of fragrances that stayed true to the core Snif DNA (i.e., high quality, accessibly priced, fun olfactive) but also felt a bit more guy-coded in their approachability and design.”

Bryan Edwards, Snif Co-CEO and Co-Founder, on Notewrks, its next big bet that launches December 4.